CHANGE IN ACCOUNTING POLICY

In fiscal 2021, FP Canada changed its method of accounting for the development costs of internally generated intangible assets from that of capitalization to expensing such costs as incurred. This change was applied retrospectively.

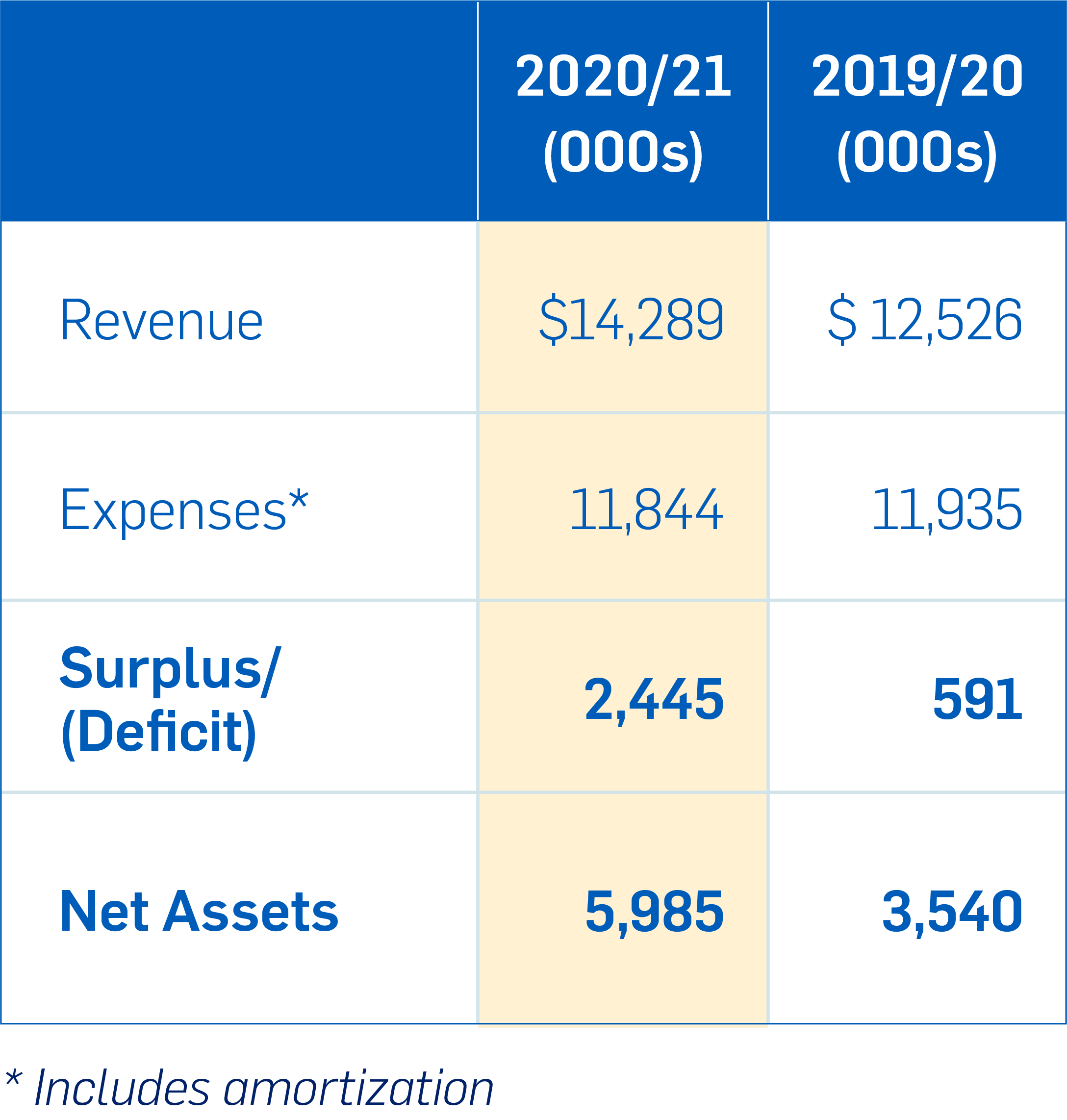

FINANCIAL POSITION

At March 31, 2021, FP Canada’s net assets are $6 million, compared to $3.5 million in 2020. Internally restricted and unrestricted net assets (“available reserves”) are $5.2 million, compared to $2.7 million in 2020. Current available reserves account for five months’ operating expenses.

FP Canada’s cash, cash equivalents and investments total $17.1 million at March 31, 2021, compared to $13.7 million in 2020. Investments are managed in accordance with Board approved investment policies and medium- to long-term investments are managed by external fund managers.

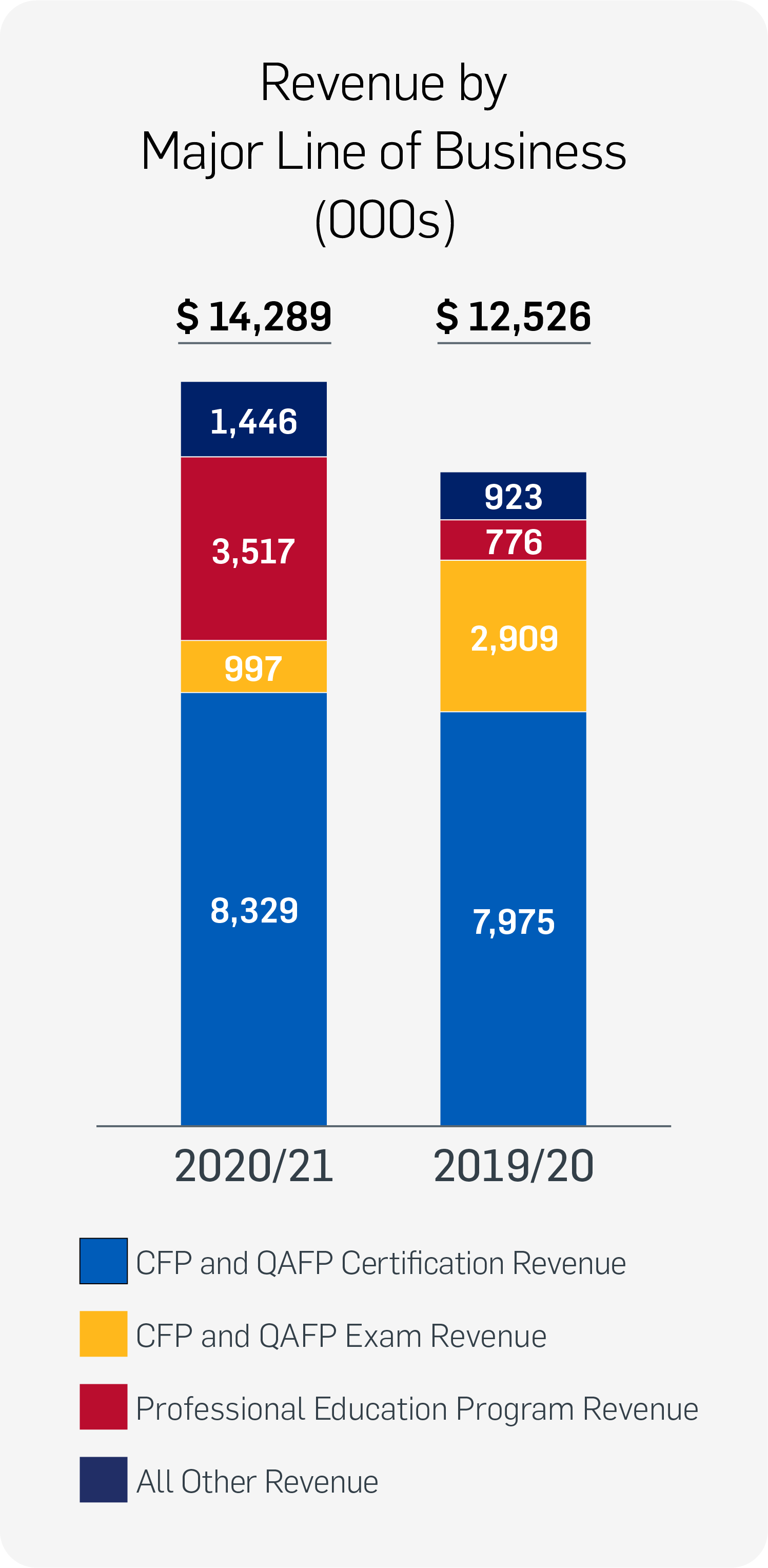

RESULTS FROM OPERATIONS

Revenue grew from $12.5 million in 2020 to $14.3 million in 2021, and comes primarily from certification fees, examination fees and Professional Education Program fees. In 2021, FP Canada earned $8.3 million in certification fees, representing 58% of total revenue, compared to $8 million in 2020, or 64% of total revenue. FP Canada earned another $3.5 million from Professional Education Program fees during the first full year since the programs launched, compared with $0.8 million in 2020. FP Canada also earned $1 million from examination fees, compared with $2.9 million in 2020. This decrease is largely attributed to the cancellation of the June 2020 exam administration due to the global pandemic.

Expenses before amortization decreased marginally from $11.8 million in 2020 to $11.6 million in 2021.

FP Canada was able to mitigate the impact from the global pandemic by adapting several business processes during the year, including shifting the annual Financial Planning Week symposium to a virtual event and offering online-proctoring as an alternative to in-person exams in November 2020.