FSRA has published a dedicated page for transition information online: www.fsrao.ca/industry/financial-planners-and-financial-advisors/transition

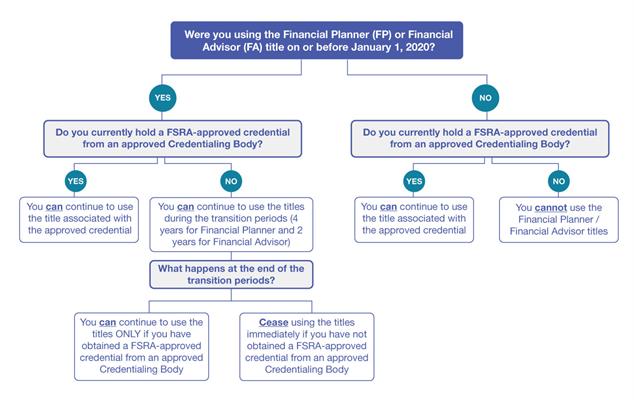

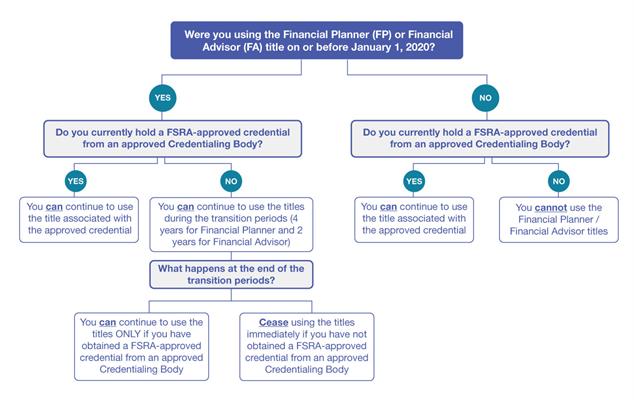

FSRA has also created the following transition chart to help practitioners understand the implementation of the new framework:

FP Canada has also developed the following scenarios to help you understand the implementation of the new framework.

Transition Scenarios for CFP Professionals and QAFP Professionals

Scenario 1: I am a CFP professional or QAFP professional who uses the title Financial Planner (or a restricted variation).

Action Required to Comply with the Framework: None. You may continue to use your Financial

Planner title (or a restricted variation) as long as you maintain your certification in good standing.

Scenario 2: I am a CFP professional or QAFP professional who uses the title Financial Advisor (or a restricted variation).

Action Required to Comply with the Framework: Unless you hold an approved Financial Advisor credential, one of the following may apply:

If you started using the title on or before January 1, 2020, you may continue using your title until March 28, 2024.

If you started using the title after January 1, 2020, you are only permitted to do so once you have obtained an approved Financial Advisor credential from a FSRA-approved credentialing body. You may alternatively use the Financial Planner title or any

other title not restricted by FSRA’s title protection framework.

Scenario 3: I am a CFP professional or QAFP professional who uses a title other than Financial Planner, Financial Advisor, or a restricted variation of either.

Action Required to Comply with the Framework: None. The title protection framework speaks only to the use of the titles Financial Planner and Financial Advisor, and their restricted variations.

Scenario 4: I am a CFP professional or QAFP professional who does not work in a client-facing role.

Action Required to Comply with the Framework: None. Regardless of whether you work directly with clients, the title protection framework affords you permission to use the Financial Planner title (and restricted variations) because you

are a CFP professional or QAFP professional. You are not required to use them, however.

Transition Scenarios for Students and Candidates on the Path to CFP Certification or QAFP Certification

Scenario 1: I am a student or candidate on the path to certification and currently use the Financial Planner title (or a restricted variation).

Action Required to Comply with the Framework: FSRA has developed transition rules for individuals currently working to obtain their Financial Planner credential:

If you started using the title on or before January 1, 2020, you may continue using your title until March 28, 2026.

If you started using the title after January 1, 2020, you are only permitted to do so once you have obtained an approved Financial

Planner credential from a FSRA-approved credentialing body. You may use any other title not restricted by FSRA’s title protection framework.

If you are successful in obtaining your CFP certification or QAFP certification, you are permitted to use the regulated Financial Planner title and any of the previously identified restricted variations of the Financial Planner title, which have likewise

been restricted by FSRA to individuals who hold an approved Financial Planner credential.

Scenario 2: I am a student or candidate on the path to certification and currently use the Financial Advisor title (or a restricted variation).

Action Required to Comply with the Framework: Unless you hold an approved Financial Advisor credential, one of the following may apply:

If you started using the title on or before January 1, 2020, you may continue using your title until March 28, 2024.

If you started using the title after January 1, 2020, you are only permitted to do so once you hold an approved Financial Advisor credential from a FSRA-approved credentialing body. You may use any other title not restricted by FSRA’s title protection

framework.

Scenario 3: I am a student or candidate on the path to certification and currently use a title other than Financial Planner, Financial Advisor, or a restricted variation of either.

Action Required to Comply with the Framework: You may continue to use your title in accordance with FSRA’s title protection framework.