Takeaways from the Money & Milestones Survey

Professional financial planners play a key role in helping Canadians not only achieve financial well-being but also create paths toward major milestones. The FP Canada™ 2025 Money & Milestones survey can offer Certified Financial Planner® professionals and Qualified Associate Financial Planner™ professionals helpful insights into the significant life goals Canadians are working towards.

What Canadians are Saving for—and What They Wish They Could Afford

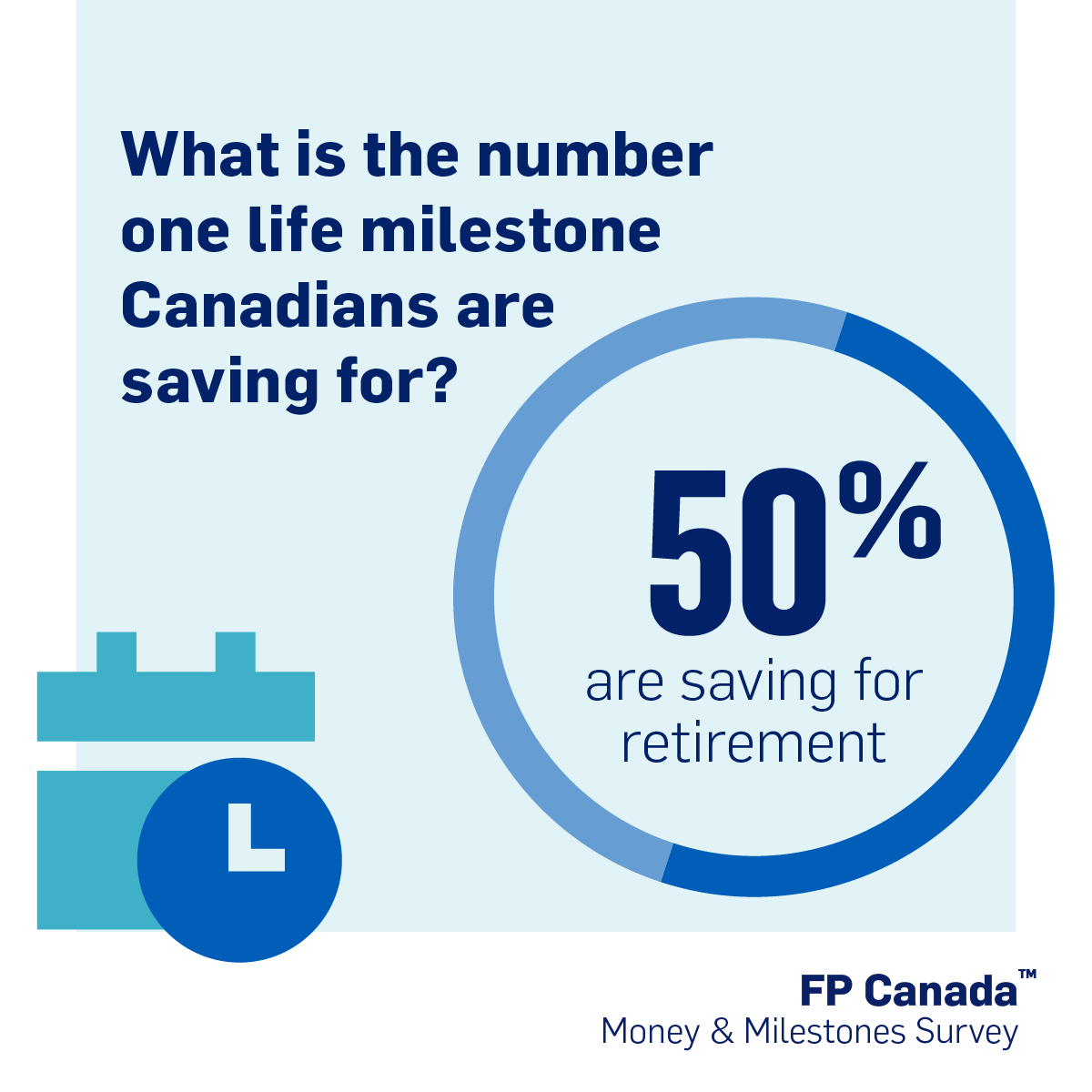

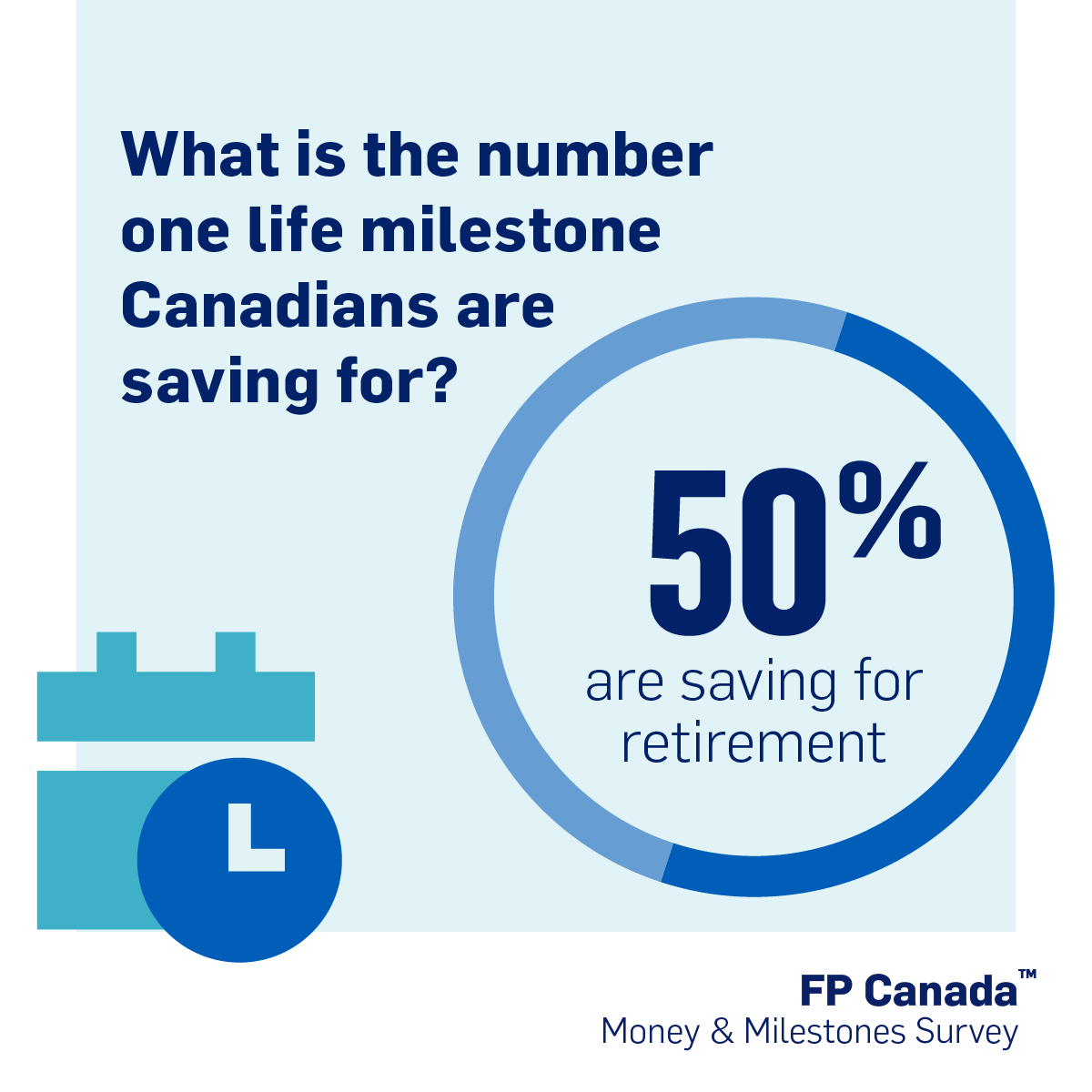

As part of the Money & Milestones survey, we asked Canadians which milestones they’re actively saving for. Half (50%) reported saving for retirement, while 42% stated that they were setting money aside for travel, and 19% said they were saving for a home. Other milestones included paying for a child’s education or their own education, starting a business, having a wedding, and starting a family.

Building on this question, we asked them what they most wish they could afford to do. More than half (53%) said that, more than anything, they wish they could afford to not worry about money. Travelling as long and as often as possible (39%) came in second, followed by fully retiring without part-time work (26%).

These responses far outranked options such as owning their dream car (11%), luxury dining and shopping (9%), or having a dream wedding (3%).

This demonstrates that when given the freedom to imagine life without financial obligations, what many Canadians envision is a life full of irreplaceable experiences, not material items. They want to enjoy their lives to the fullest.

Exploring this idea with clients when appropriate may help uncover deeper insights about their greatest aspirations. This can help ensure their financial plans reflect what they want most in life.

Differing Views on Retirement

The Money & Milestones survey found that the number one life milestone Canadians are saving for is retirement. But what they expect this life stage to look like varies significantly.

The Money & Milestones survey found that the number one life milestone Canadians are saving for is retirement. But what they expect this life stage to look like varies significantly.

Over a quarter (26%) are saving for a retirement where they’ll work less, compared to over a third (35%) who are saving for a retirement where they won’t work at all. The fact that so many are actively saving for a non-traditional retirement is another reminder that every Canadian’s vision of their future is unique.

When taking a closer look at the numbers, there are significantly more Canadians aged 35-54 and 55+ who are saving for full retirement (48%), as opposed to semi-retirement (28%). But for those aged 18-34, it’s a nearly even split (with 20% saving to stop working completely, versus 21% who plan to work less).

Clearly, when it comes to retirement, the path to saving will look different depending on the client—and often, age is an important factor.

Your Role as a Professional Financial Planner

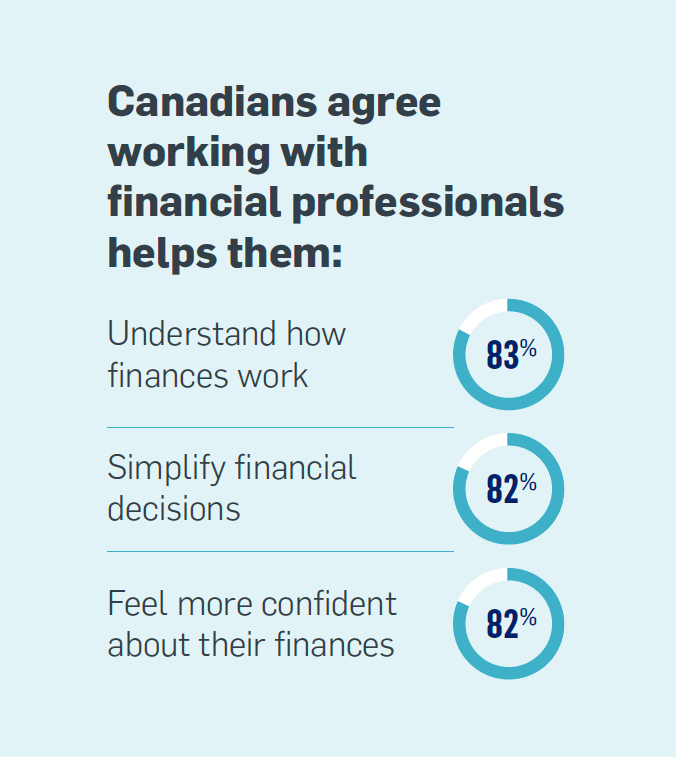

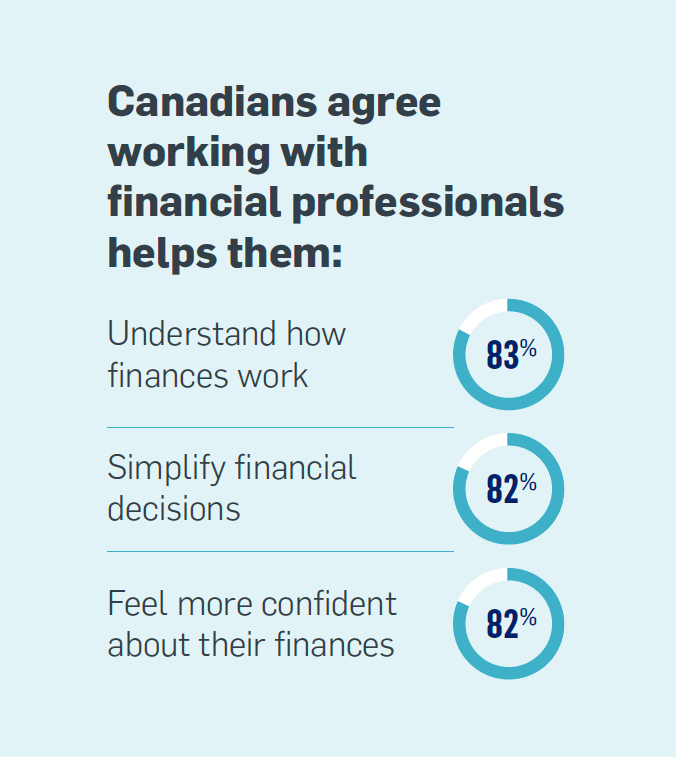

Here’s a finding that should come as no surprise: Canadians deeply value the advice of financial professionals. The Money & Milestones survey found that the majority of Canadians (83%) agree that working with a financial professional, such as a CFP® professional or QAFP® professional, helps them understand how finances work. Likewise, most say it simplifies their financial decisions (82%), helps them feel more confident about their finances (82%), and provides them with peace of mind (79%).

As a CFP professional or QAFP professional, you have the knowledge, skills, and ethical understanding to guide your clients towards their financial goals. The Money & Milestones survey can help by shedding light on the milestones that matter most to Canadians. This information may come in handy as you seek to understand your clients and help them build personalized roadmaps toward financial well-being.

For further insights and resources, visit our Money & Milestones survey web page.

The Money & Milestones survey found that the number one life milestone Canadians are saving for is retirement. But what they expect this life stage to look like varies significantly.

The Money & Milestones survey found that the number one life milestone Canadians are saving for is retirement. But what they expect this life stage to look like varies significantly.